This is not a full list, but just some examples. The article made me think about past PLM architecture consolidations in the industry and what was the success rate of merging integrations of technologies and products. Supporting 3 PLM systems could be a nightmare, though, so that transition will have to happen fairly quickly, organically, or be helped along by licensing and other means.

It seems more likely to me that we’ll see Windchill and Arena sold as they are, then customers being transitioned to the new Atlas-based PLM when they are ready to make that jump.

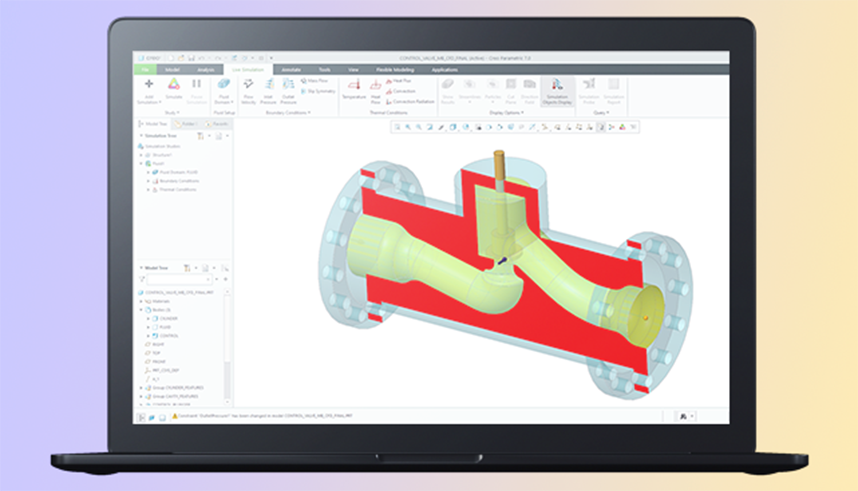

I wouldn’t be at all surprised if the resulting PLM takes the best of Windchill, Arena and anything else PTC comes up with as this all evolves. PTC has embarked on an ambitious plan to build on the SaaS technology it acquired with Onshape in what it’s calling Atlas - the Saas-ifying of Creo, Windchill, Vuforia, and ThingWorx over the next few years. But what about technology consolidation? According to Monica, it is unlikely to happen. My attention was caught by Monica Schnitger’s article – Will PTC+Arena = SaaS dominance in PLM? The conclusion of the article PTC will be able to freeze their competitors by selling Arena to SMB customers and maybe long term to move faster with Atlas development. But the real question that was asked by many industry observers, analysts, and customers are how PTC will solve the PLM SaaS puzzle it created. The same is happening now after PTC announced their acquisition of Arena Solutions for $715M (). MatrixOne, Solidworks Enterprise PDM, FlexPLM, and some others.

It happened many times in the past, substantial PLM businesses were acquired – Agile PLM. What options does PTC have to integrate Arena Solutions into the Atlas platform?Įach time any major PLM vendor makes a big step onto the acquisition path, the questions about how the technologies and products will be merged and how it will impact the customers.

0 kommentar(er)

0 kommentar(er)